For those new to cryptocurrencies, transferring assets from a cryptocurrency exchange to a secure and personal cold wallet can seem like a daunting task. This article will provide information and guidance on the steps required to safely move your cryptocurrency assets to an offline cold wallet. In a cold wallet your cryptocurrency assets can be stored securely and away from hackers or other online bad actors.

Table of Contents

- What is Cryptocurrency?

- Global Cryptocurrency Adoption

- Social/Cultural Pros and Cons to Owning Cryptocurrency

- Cryptocurrency Exchanges

- Cryptocurrency Keys

- Cold Wallet Storage

- Transferring Cryptocurrency from an Exchange onto a Cold Wallet?

- Setting Up Your Cold Wallet for Cryptocurrency Storage

- Transferring Cryptocurrency from an Exchange to Your Cold Wallet

- Prerequisites

- Step 1: Log into your exchange account and your cold wallet device

- Step 2: Choose the cryptocurrency to be transferred to your cold wallet.

- Step 3: Set up a cold wallet and generate/import private keys.

- Step 4: Initiate the transfer of cryptocurrency from the exchange onto your cold wallet.

- Step 5: Monitor the transfer of the cryptocurrency from the exchange to your cold wallet.

- References

- Glossary

Caution

Cryptocurrencies are volatile and risky.

Investing and speculating in cryptocurrencies involves considerable financial risks and may not be suitable for all types of investors. You may lose all or part of your investment. Do not invest or speculate with more money than you can afford to lose. It is highly advised you seek the advice of a financial planner prior to risking any funds. If your investments cause you to lose sleep a night, then you should not be investing in them!

Invest and speculate at your own peril!

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of payment that uses cryptography to verify and record transactions. Cryptocurrency transactions occur on a decentralized data system utilizing distributive ledgers enforced by a disparate network of computers to facilitate cryptocurrency transactions on a blockchain. Most but not all cryptocurrencies conduct transactions on a blockchain; however, alternative technologies like Hedera, a cryptocurrency token operating on the Hedera Hashgraph, function similarly to those cryptocurrencies using the blockchain.

Cryptocurrencies are predominately bought, sold, and traded on online exchanges. Cryptocurrency transactions are becoming increasingly popular with individuals and businesses alike due to their decentralized nature, their speed and ease at conducting international monetary transactions, the reduction in price volatility due to fluctuating inter-bank currency transactions rates, and their lack of government control and over-regulation.

Global Cryptocurrency Adoption

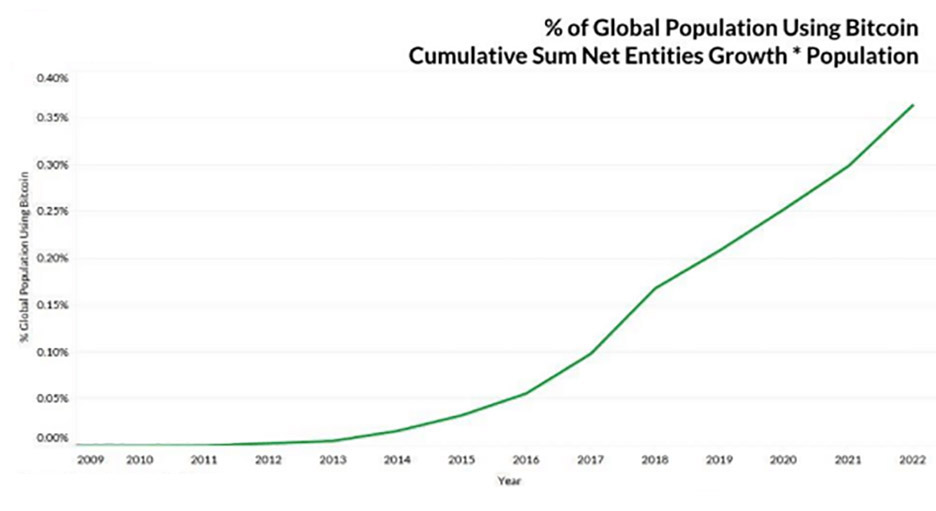

Cryptocurrency adoption has increased every year since data on global adoption was first collected, and adoption continues to increase every year. In 2020, the total number of cryptocurrency users worldwide reached over .25% (19.5 million). For 2023, it is estimated that global crypto ownership rates will increase to 4.4%, with over 350 million cryptocurrency users worldwide.

This growth is largely attributed to the rising popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs). In addition, many countries are beginning to explore the potential of blockchain to improve their economies and financial systems. As a result, more businesses and individuals are becoming interested in cryptocurrencies. For 2023, it is estimated that global crypto ownership rates will increase at an average of 4.4%, with over 400 million crypto users worldwide. Source: The Central Bank of Singapore.

Social/Cultural Pros and Cons to Owning Cryptocurrency

The cultural and social issue reasons for transferring cryptocurrency off of an exchange and to a cold wallet are largely related to increased privacy, independence from the central banking system, and the environmental damage caused to the enviorment (carbon footprint) caused by engagin in cryptocurrency transactions.

By keeping cryptocurrency assets in a cold wallet, users are able to limit the amount of information available to third parties, such as exchanges. This helps protect users from identity theft and other malicious activities, as their personal information is kept private and also affords some privacy from overbearing governmentregulators. Storing cryptocurrency assets in a cold wallets also makes it easier for people in isolated or politically unstable regions to protect their financial assets and access them at a time and place of their own choosing.

Additionally, having added control and security through the use of cold wallets also makes it easier for users to bypass certain onerous government regulations, allowing them to protect their cryptocurrency assets from control, seizure, and/or confiscation that can occur in repressive regimes.

Below are a few pros and cons to owning cryptocurrency:

Pros:- Independence from fiat currency and the de facto banking system.

- The potential to mitigate financial collapses due to inflation, hyperinflation, stagflation, deflation by providing a reserve of value.

- Financial inclusion of populations formerly "debanked" due to unequitable access to financial and/or banking channels. The ability to hold and maintain personal cryptocurrency-based funds in their own, private, secure wallet is inclusionary in the world economy.

- Offers more efficient and timelier cross-border transaction processing (eliminating the banks and other middle tier, funds processing financial opportunists)

- Reduction/elimination of centralized banks and the traditional, de facto, fiat currencies.

- Many cryptocurrencies present a large carbon footprint during the mining process and funds transaction process.

- Reduction/elimination of centralized banks and the traditional, de facto, fiat currencies.

- Less government oversight and regulation.

- A potentially economic destabilizing force.

Cryptocurrency Exchanges

A cryptocurrency exchange is an online platform that facilitates the trading of digital assets, including cryptocurrencies. Cryptocurrency exchanges are becoming increasingly popular for digital asset trading. They are based on a decentralized blockchain network, meaning that no single person controls the exchange and users interact directly with one another. Exchange platforms provide a secure environment for users to buy, sell, and trade cryptocurrencies in various forms, including taking part in Initial Coin Offerings (ICOs) and trading on various timeframes, including day, swing, and long-term buy and hold.

Additionally, exchanges allow users to buy, sell, and trade digital assets for fiat currencies, such as the US dollar or British pound. Furthermore, exchanges may also act as a central clearing house for performing financial transactions, such as transferring money from one user to another. The platform's security measures, such as two-factor authentication, help to protect users’ monetary investments and safeguard personal financial information.

Besides cryptocurrency exchanges, many cryptocurrencies can also be traded on online peer-to-peer (P2P) exchanges, over-the-counter (OTC) exchanges, and decentralized exchanges. P2P exchanges are platforms where users can trade directly with each other. P2P exchanges are an effective way to purchase and sell cryptocurrency without the need for intermediaries. In every case, the chosen exchange platform connects buyers and sellers, allowing them to trade directly between themselves.

OTC exchanges are like the other types of exchanges but require a third-party intermediary to facilitate the transaction. OTC exchanges allow buyers and sellers to trade directly with each other with the assistance of the third-party facilitator. Decentralized exchanges do not require any third-party intermediaries but are otherwise similar to O-T-C exchanges in other respects.

Decentralized exchanges are platforms where users can trade directly with each other via blockchain technology. In all cases, cryptocurrency wallets are necessary for holding, protecting, and transferring cryptocurrency assets whether the cryptocurrency assets are held on the exchange or off-exchange in a private wallet. Each user must have their own wallet along with their own cryptographic keys in order to transact with cryptocurrency.

Cryptocurrency Keys

Cryptocurrency keys are cryptographic pieces of data used to secure and access cryptocurrency wallets. Cryptocurrency keys are essential for any cryptocurrency user, as they are necessary to securing and accessing the individual's cryptocurrency wallet. Each key consists of two components, a public key and a private key. The public key is used when another person is sending cryptocurrency to the individual, while the private key is required to access the wallet and send cryptocurrency from it. This means that the private key must be kept secure at all times as it is the only way to access the funds in the wallet. Furthermore, extra precautions should be taken to make sure that the private key is not stolen or accessed by unauthorized individuals. Not only is this important to secure the funds in the wallet, but it can also prevent unauthorized transactions from being made. It is important to keep your private key secure as it is the only means of accessing your cryptocurrency funds.

The phrase "Not your keys, not your crypto" is a reminder to cryptocurrency users that they are ultimately responsible for keeping their assets safe. It reminds users that they should never share their private key or keys with anyone else, as this may render them unable to access their funds, or worse, may allow for the theft of their cryptocurrency assets. It also implies that each type of cryptocurrency has its own unique key, and that these keys must be securely stored and protected to ensure the safety of the user's funds. By taking responsibility for their own cryptocurrency and not trusting anyone else with their private key, users can protect their investments and avoid potential losses.

Keys are the records of ownership of cryptocurrency assets. Storing your keys in a secure location such as a cryptocurrency wallet is the best way to ensure that they remain safe and accessible when you need them. Without access to a key associated with ownership of cryptocurrency, no transactions or proof of ownership can be established. Cryptocurrency keys should be stored in a secure wallet. Cryptocurrency wallets have multiple layers of encryption that help keep your keys secure and provide additional layers of protection against theft or loss. Additionally, they offer the convenience of being able to access your keys at any time, from anywhere. Therefore, it is highly recommended that you store your keys in a reliable, secure location such as a cryptocurrency wallet. By keeping your keys safe in a secure location inside a wallet, you can ensure that you remain in control of your cryptocurrency transactions and ownership.

Cold Wallet Storage

A cryptocurrency wallet is an important tool for managing and using digital assets. It acts as a digital storage space for storing digital assets, such as cryptocurrencies, and allows users to make transactions using them. Furthermore, cryptocurrency wallets are used to track assets and keep records of their transactions. It's essential to take steps to secure your wallet and back it up regularly, in case of loss or theft. Additionally, there are different types of wallets available that provide different levels of security and features. For instance, some wallets emphasize the protection of assets using the highest level of security while others provide a range of features to ease the process of managing digital assets.

There are many different types of cryptocurrency wallets. Some of the most popular types of wallets are indicated in the following table:

| Wallet Type | Description | Example | ||

|---|---|---|---|---|

| Desktop | A desktop wallet is a common type of software-based wallet allowing the user to securely store and manage their private keys on a computer hard drive. Desktop wallets are easy to set up and allow the user to store, send, and receive cryptocurrency from the convenience of their computer. |

Guarda Wallet | ||

| Mobile | A mobile wallet is an application downloaded to your smartphone or digital device which allow users to securely store, send, and receive cryptocurrency. Mobile wallets are a convenient way for a user to make in-store payments using cryptocurrency and can be used at merchants listed with the mobile wallet service provider. |

Rainbow Wallet | ||

| Web-based | Web-based wallets are online storage platforms which allow users to store their crypto assets online, making them accessible from any device with an internet connection. Online wallet are accessed via the internet through a browser. They are commonly referred to as web wallets. |

Coinbase Wallet | ||

| Paper | Paper wallets are physical documents containing all the data necessary to generate a set of private keys, allowing users to securely store their coins offline. In essence, all cryptocurrency information, including account credentials and cryptocurrency keys, are recorded on a sheet of paper. Paper wallets are easily lost, stolen, or destroyed. Paper wallets are not recommended! |

Paper | ||

| Cold | Cold wallets are physical devices designed to securely store cryptocurrency. They come in the form of USB drives and other portable, peripheral devices, and are used to store private keys offline. A cold wallet, a type of cold wallet, ia a physical device capable of providing one of the most secure ways to keep cryptocurrencies. They work by storing the user's private keys in an external, physical device (usually a USB or Bluetooth device). Cold wallets are HIGHLY recommended! |

Ledger Wallet | ||

| Exchange | Exchange wallets are hosted on cryptocurrency exchanges and allow users to store their cryptocurrency in one place. While convenient, if the exchange goes down due to an IT issue or becasue of financial difficulty, it is a high probability that you will never be able to recover your crypto assets. Another weakness with exchange wallets is their high susceptibility to hackers and other nefarious no-gooders. |

Binance Wallet | ||

| Layer 2 | Layer 2 wallets leverage the second layer of blockchain technology. Layer 2 wallets are designed to enhance the speed and reduce the cost of performing transactions on a blockchain, thus reducing gas fees. Layer 2 wallets improve blockchain scalability by reducing the number of nodes or participants required to validate transactions within the Layer 2 network, thereby reducing the time and cost it takes to achieve consensus. |

Trust Wallet | ||

| Stealth | Stealth wallets generate a unique address for each transaction, helping users maintain their anonymity and privacy. They are very secure. The perfect choice for those interested in providing heightened security and protection for their cryptocurrency assets. Stealth wallets are HIGHLY recommended for those users requiring added security. |

ZenGo Wallet |

Transferring Cryptocurrency from an Exchange to a Cold Wallet

One of the most difficult tasks for cryptocurrency novices to learn is how to transfer their cryptocurrency assets held on an exchange to the safety and security of their own cold wallet. Learning how to transfer cryptocurrency assets from an exchange to a wallet is a challenging process. It requires users to have both the public address of the wallet and the private key.

The process of transferring your cryptocurrency assets from one platform to the other will require rigorous testing and evaluation to ensure the asset is safe and secure throughout the transfer, since the digital asset could be susceptible to cyber-attacks. It is highly recommended that a test transaction involving only a small amount of cryptocurrency, thus providing the opportunity to verify receipt of assets into the cold wallet prior to transferring large amounts of cryptocurrency possessing a high monetary value.

Cold wallets are an ideal choice for anyone looking to securely store their cryptocurrency. Since cold wallets are physical devices that store cryptocurrency offline, they offer stronger security than hot wallets or other types of wallets. It is because of their increased security and their ability to store cryptocurrency assets offline that cold wallets are recommended as the best means of cryptocurrency storage. Because of this, cold wallets offer cryptocurrency owners peace of mind when it comes to keeping their cryptocurrencies safe and secure.

Because cold wallets are stored offline and are not connected to the Internet, there is no risk of theft or hacking. Furthermore, these wallets provide additional features such as PIN codes and two-factor authentication for an extra layer of protection. To further enhance security, cold wallets do not require any personal information, thereby reducing the risk of identity theft. Additionally, these wallets are highly portable because they are stored on physical devices such as USB sticks or external hard drives. Overall, cold wallets offer a reliable and secure way to store cryptocurrency.

While cold wallets offer safety and security for cryptocurrency assets, they cannot be used as a way to avoid detection of cryptocurrency holdings by government or other entities, as the transactions that occur between the cold wallet and any form of cryptocurrency exchange are still recorded on the digital ledger known as the blockchain and can be traced.

Consequently, cold wallets provide an additional layer of security and privacy, but not complete anonymity, as digital footprints can still be tracked. However, cold wallets can be used to convert traditional, fiat currencies into a form of cryptocurrency that is more trustable, especially during times of economic uncertainty, such as during periods of high inflation, hyperinflation, monetary devaluation, or financial panic, or as a means of preserving and protecting wealth during government breakdown or political uncertainty. When scenarios like these occur, a cold wallet can be used to convert fiat currency to cryptocurrency thus providing increased safety and security than conventional currencies while providing a viable option of holding financial assets in a digital currency that is less prone to drops in value than its fiat equivalent.

Cold wallets enable users to store and transfer digital assets securely in a decentralized manner, without relying on traditional banks. This offers convenience and flexibility as users don't have to go through the traditional banking network in order to transact business. With a cryptocurrency cold wallet, funds can be transferred almost instantly without the risks associated with conventional banking operations. Furthermore, when users need to access their cryptocurrency holdings, they can use the digital assets stored in the cryptocurrency wallet to pay debts or convert them into the local fiat currency almost anywhere in the world.

Why Transfer Cryptocurrency Off an Exchange and onto a Cold Wallet?

Cold wallets are an increasingly popular option for users who want to securely store and transfer their cryptocurrency assets. Overall, transferring cryptocurrency from an exchange and onto a cold wallet provides asset owners with a more secure and private storage solution. The offline nature of a cold wallet ensures that users are able to keep their digital assets safe from malicious activities while also limiting the amount of information available to third parties. The added security, privacy, and control that cold wallets offer make them a valuable storage solution for those looking to keep their digital assets safe and secure and under their own management.

Unlike exchanges, cold wallets offer users more control over their funds. The private and secure nature of cold wallets means that users do not have to depend on the services of third parties to access or transfer their cryptocurrency assets. This independence enables users to manage their funds in a safe environment, and gives them more freedom to store, send, and receive digital assets securely and quickly. Furthermore, the private nature of cold wallets prevents any sensitive personal information from being shared with third parties, protecting users from identity theft.

There are many reasons to transfer your cryptocurrency to your cold wallet, but the following three reasons are particularly important:

1. Security

Unlike exchanges, cold wallets offer users better security over their cryptocurrency assets than keeping them stored in an exchange wallet. The private and secure nature of cold wallets means that users do not have to depend on the services of third parties to access or transfer their cryptocurrency assets. This independence enables users to manage their funds in a safe environment, and gives them more freedom to store, send, and receive digital assets securely and quickly. Furthermore, the private nature of cold wallets prevents any sensitive personal information from being shared with third parties, protecting users from identity theft. Additionally, the offline nature of cold wallets also makes them ideal for storing larger amounts of cryptocurrency assets in a safe, secure location reducing the risk of having assets seized by government authorities for any number of reasons.

2. Privacy

In addition to offering users increased security and control, transferring cryptocurrency off of an exchange and to a cold wallet also offers users greater privacy. By keeping the cryptocurrency assets in a cold wallet, owners of cryptocurrencies are creating an additional layer of security that is not provided by exchanges or any other form of online storage. Offline storage as afforded when using a cold wallet limits the amount of information available to third parties, ensuring their personal data remains private.

3. Control

The control reasons for transferring cryptocurrency from an exchange and onto a cold wallet include increased control over funds, and the ability to transact financial business whenever desired, wherever desired. wallets enable users to store and transfer digital assets securely in a decentralized manner, without relying on traditional banks. This offers convenience and flexibility as cryptocurrency owners no longer have to go through the time-consuming process of setting up bank accounts or going through paperwork in order to complete a financial transaction. With a cold wallet, cryptocurrency owners can transfer funds quickly, without having to worry about transaction fees or risks associated with banking operations. Additionally, users don't have to rely on exchanges or other online services to access their finances, providing them with even more control over their funds.

Setting Up Your Cold Wallet for Cryptocurrency Storage

One of the most difficult tasks for cryptocurrency novices to learn is how to transfer their cryptocurrency assets held on an exchange to the safety and security of their own cold wallet. Learning how to transfer cryptocurrency assets from an exchange to a wallet is a challenging process. It requires users to have both the public address of the wallet and the private key.The following are prerequisite to setting up and configuring a cold wallet:

- cold wallet. Recommended brands include Trezor, Ledger, and NGrave. It is important to purchase your cold wallet directly from the manufacturer's website and not from a secondary source, such as Amazon or eBay, as unauthorized resellers often sell counterfeit products. Additionally, when purchasing a cold wallet, you should double-check that the device was securely sealed in its original packaging.

- The latest cold wallet support application installed on your cold wallet. The latest version of the wallet’s support software should be downloaded from the wallet manufacturer's website and installed on the connecting the cold wallet device prior to transferring cryptocurrency assets to it. The cold wallet’s support software should be regularly updated with the most recent version to ensure compatibility and safety.

- A computer or device running the most recent OS version. It is important that the system to which you are connecting your cold wallet has the latest updated operating system installed and has been scanned for viruses, malware, and other security threats. This ensures that the wallet is running on an up-to-date operating system safe from potential cyber threats. Most cold wallets support Windows, MacOS, Linux, Android, and iOS.

Step 1: Set up and configuration of your cold wallet.

Note: For information on the set-up and configuration of the following popular cold wallet devices, please refer to the manufacturer’s official website for instructions:

To set up most wallet devices, follow the screen-based set up wizard that comes with the cold wallet device. This allows for a relatively straightforward set up process. For wallet devices that do not support a wizard-base set up system, refer to the set-up instructions that came with your device or refer to the manufacturer’s website for specific instructions on how to set up your device. This may require a more detailed set up process and a higher level of technical skill. It is important to follow all instructions carefully in order to ensure successful installation and secure storage of your cryptocurrencies.

Step 2: Create a PIN that will be used going forward for unlocking and accessing your wallet device.

PINs are typically between 4 or 8 characters in length and should be memorized. It is also recommended to store a copy of your PIN in a location that is not accessible to the Internet, such as a bank deposit box. This helps to ensure that your PIN remains confidential and secure. If you ever forget your PIN, the manufacturer’s website often provides instructions on how to reset your PIN so that you can access your wallet again.

Step 3: Create a recovery phase.

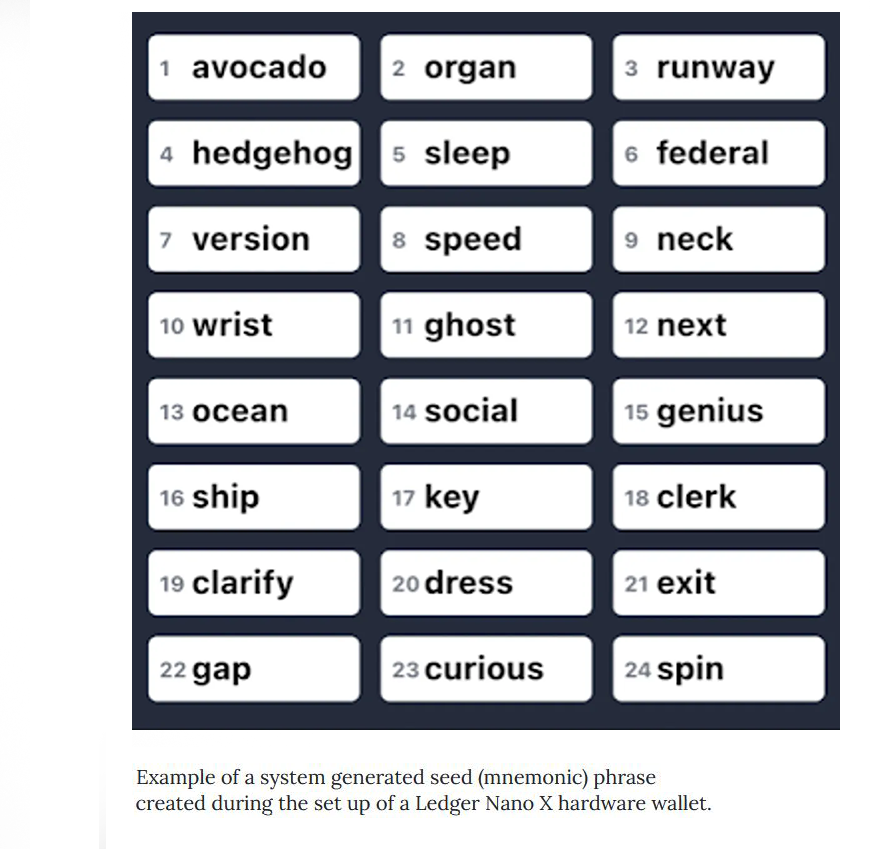

A recovery key is used in cases where you have lost your PIN and are unable to retrieve the PIN sequence. It is a long string of random characters that acts as an additional layer of protection for your wallet. In the event that you lose your PIN, the recovery key can be used to access your wallet without compromising the security of your private keys. The recovery key should be securely stored in a secure location or multiple locations in order to prevent any unauthorized access.

Recovery phrases are usually generated by the end user but can also be system generated by the device and are typically between 20 and 24 words in length. It is important to record your recovery phrase in a secure location that is not accessible online, such as a safety deposit box. Never use a PIN or recovery phrase that has been provided by a manufacturer prior to the wallet’s purchase or one that is printed in an instruction manual or other printed document, as these may have been exposed to third parties. The recovery phrase should only be used by you and should be kept secure at all times.

WARNING!

DO NOT share your recovery phrase. Anyone in possession of your recovery phrase has access to your cryptocurrency assets and can transfer them from your account without your permission or knowledge. It is therefore essential that you keep your recovery phrase safe and secure. Never share your recovery phrase with anyone, even if a trusted individual asks for it.

Step 4: Install wallet app/worker scripts.

Install specific applications/worker scripts on your wallet device, based on what type of cryptocurrency you want to store in the wallet from the manufacturer's website. For example, if you want to store Bitcoin in your cold wallet, install the worker script for the device manufacturer’s website. This will ensure that the wallet is compatible with the specified cryptocurrency and that it can communicate with the blockchain network. Additionally, different types of cryptocurrencies may require different types of wallet technology, so it is important to make sure that the device supports the type of cryptocurrency that you plan to store in the wallet.

Note: After completing the set up and configuration of your cold wallet, you'll need to record the private address of your cold wallet and save it in a safe, secure, offline location for future reference.

Transferring Cryptocurrency from an Exchange to Your Cold Wallet

Transferring cryptocurrency assets between your cold wallet and an exchange or other location can be done by either sending or receiving the funds through the network. If sending funds, you will need to generate a transaction from the wallet containing the address of the recipient and the amount of the funds being transferred. The transaction is broadcasted to the blockchain network for confirmation by the miners, at which time the transaction will be added to the public ledger. If receiving funds, you will have to provide the sender with the address generated from your wallet. Once the funds have been sent, they will appear in the wallet’s balance after the transaction has been confirmed by the blockchain network.

Prerequisites:

The following are prerequisite to transferring cryptocurrency to your cold wallet:

- An exchange account with Coinbase, Binance, Gemini, or other cryptocurrency exchange that is licensed to operate in your legal jurisdiction.

- Purchased cryptocurrency assets residing in your cryptocurrency exchange account.

- A configured cold wallet with worker scripts installed specific to the cryptocurrency type to be transferred to your cold wallet.

Step 1: Log into your exchange account and your cold wallet device

Log into your online exchange account and the cold wallet device. Verify that both accounts are active and ready to accept transactions. Check the balances in your exchange account. Make sure that the transaction amount is within your account limits as well as the transfer limits specified by the exchange. Some exchanges may not allow transfers over a certain monetary amount or may limit the number of transactions per day, per week, or per month. It is your responsibility to read the exchange's terms of service agreement. Once you have confirmed that all information is correct in your exchange account and in your receive account (your cold wallet), you'll need to gather the information required to initiate and complete the cryptocurrency transfer.

Step 2: Choose the cryptocurrency to be transferred to your cold wallet.

When preparing to transfer cryptocurrency, you should navigate to your online cryptocurrency exchange's account page where you should select the cryptocurrency you would like to transfer to your cold wallet. Enter the public address of the wallet, and specify the type pf cryptocurrency to be transferred along with the amount of cryptocurrency you wish to transfer. After confirming the transaction, the funds will be sent to your wallet. It is essential to protect the private key, as it is the only way to access your cryptocurrency funds once transferred to your wallet.

When choosing the cryptocurrency to transfer to a cold wallet, make sure that the cryptocurrency is supported by the cold wallet. Not all cold wallets support the transfer of all types of cryptocurrency. Therefore it is important to double-check before transferring funds. Additionally, verify the transaction fees for sending the funds from the exchange to your cold wallet prior to initiating the transfer.

Each cryptocurrency asset in your account has a unique access and key associated with it. Collect the send/receive keys/address information for the cryptocurrency to be transferred to your wallet, along with the amount of cryptocurrency to be transferred prior to initiating the cryptocurrency exchange. Depending on the exchange platform, you may need to provide either your public wallet address for sending funds or your private key for receiving funds. It is important to double-check these keys/addresses to make sure the funds are being sent to the correct exchange or wallet. Additionally, the exchange platform may also require additional authentication such as two-factor authentication or a voice verification code to ensure secure transactions.

Step 3: Set up a cold wallet and generate/import private keys.

Once you have chosen the cryptocurrency and verified the necessary details, you can proceed with setting up a cold wallet that is compatible with the chosen currency. You will need to create an account on the cold wallet, generate or import private keys, and back up your wallet to ensure the security of your funds.

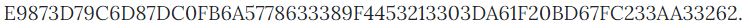

For example, a private Bitcoin key is a 64-character string of letters and numbers. It might look something like this:

Step 4: Initiate the transfer of cryptocurrency from the exchange onto your cold wallet.

Once the transfer request from has been filled out, you can initiate the transfer of your cryptocurrency to your cold wallet. Verify the keys and receive address of your cold wallet are correct prior to initiating the transfer. To be safe, before transferring a large amount of cryptocurrency, it is wise to initiate a small transfer of cryptocurrency to verify the receive address of your wallet is correct.

Step 5: Monitor the transfer of your cryptocurrency assets off of the exchange and on to your cold wallet.

Typically, the transfer of cryptocurrency assets from one address to another address can take been a few seconds to several minutes. During peak usage times, it may take more time than is usual to complete the transfer process. When the transfer is complete, your cold wallet will reflect the amount of cryptocurrency transferred into it.

Congratulations! You've successfully transferred cryptocurrency from the exchange to the safety and security of your own cold wallet. The same transfer process is used when making transactions involving cryptocurrency to any address on the internet for purchases, the transfer of cryptocurrency assets back to an exchange, or to a different cryptocurrency wallet.

References

The following is a list of cryptocurrency references that can be used in your quest to gain insight and knowledge on cryptocurrencies:

Binance.US: Binance.US, a subsidiary of Binance.COM, is an American cryptocurrency exchange serving U.S.-based investors and purchasers.

www.binance.us

Blockworks: Blockworks provides information and breaking crypto news, in-depth research reports, and data dashboards that illustrate on-chain metrics.

blockworks.co

Coinbase: Binance.US, a subsidiary of Binance.COM, is an American cryptocurrency exchange serving U.S.-based investors and purchasers.

www.coinbase.com

Coin Desk: CoinDesk is a source for news articles, videos, podcasts, and newsletters for breaking news and expert opinions on cryptocurrency subject matter.

coindesk.com

Coin Metrics: Coin Metrics ia an open-source project to determine the economic significance of public blockchains. Its goal is to empower people, allowing them to make informed, financially based, cryptocurrency decisions.

coinmetrics.io

Glassnode: Glassnode is a key source for analytics and data on cryptocurrencies niche.

glassnode.com

Reddit: Reddit is a social media site where cryptocurrency investors and speculators can discuss all things involving cryptocurrencies. The subreddits of r/ethereum, r/cryptocurrency, and r/Bitcoin provide information on cryptocurrency topics.

reddit.com

Glossary

The following is a glossary of common cryptocurrency terminology and their definitions:

Bitcoin: Bitcoin is a type of digital currency in which a record of transactions is maintained and new units of currency are generated by the computational solution of mathematical problems, and which operates independently of a central bank.

Blockchain: A blockchain is a digitally distributed, decentralized, public ledger that exists across a network.

Coinbase: Coinbase is a secure online platform (exchange) for buying, selling, transferring, and storing cryptocurrency. It is the most well-known cryptocurrency exchange.

Cold Wallet: A cold wallet is a type of cryptocurrency wallet that securely stores your private crypto keys offline, usually on a physical device. It is also known as a hardware wallet, and it protects and secures your digital cryptocurrency assets from online hackers.

Cryptocurrency: Cryptocurrency is a digital currency in which transactions are verified and records maintained by a decentralized system using cryptography, rather than by a centralized authority.

Debanked: Debanked is the condition where access to a bank or the ability to use a bank or banking services is denied or curtailed due to race, economic status, location, or politics to a financial institution. It is predominantly done with intent to disenfranchise certain classes of people from saving their assets within the banking system.

+ Exchange (cryptocurrency): A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies.

Hedera: Hedera is a fully open source, proof-of-stake, public network and governing body for building and deploying decentralized applications. it offers an alternative to blockchain technologies such as Bitcoin.

Hashgraph: Hashgraph is the technological network on which Hera resides and operated. It offers an efficient, carbon neutral alternative to blockchain technologies.

Layer 1: Layer 1 refers to a foundational blockchain on which blocks are produced, transactions are finalized, and a native cryptocurrency coin is used to pay transaction fees and reward those who secure the network. The most popular L1 chains are Bitcoin and Ethereum.

Keys: There are two types of keys: public and private. A public key is the address where payments to a cryptocurrency account occur. A private key is the address or location where cryptocurrency resides on the network. Access to a private key can be used to withdraw and transfer cryptocurrency assets from a user account and move it to a different account.

technologies.

Non-fungible: NFTs (non-fungible tokens) are unique cryptographic tokens that exist on a blockchain and cannot be replicated. NFTs can represent digital or real-world items like artwork and real estate.

Recovery Phrase: A recovery phase is required to recover the private key addresses of cryptocurrency assets if a cold wallet or other wallet device is lost or stolen. Without a recovery phrase, the cryptocurrency assets are lost and cannot be recovered. A recovery phrase should be stored in a secure location such as a bank deposit box or safe. Preferably in more than one highly secure place.